Approved Mileage Rates

Approved Mileage Rates

This article is an introduction to business mileage – which is mileage travelled in your own car – and explains how much you are entitled to claim at the time of writing this post.

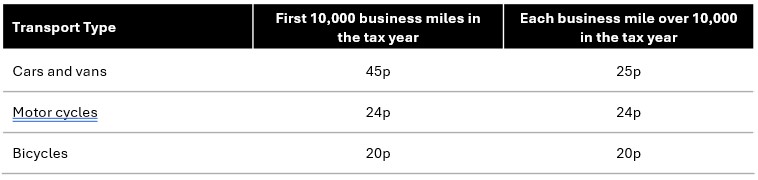

If you or your employees travel on business in a private car (that’s not a company car), you could record this as a mileage claim for which you are able to reclaim the cost (at HMRC approved rates) from the business. Currently the mileage rates are set at 45p per mile for the first 10,000 miles for cars and vans. After 10,000 miles, the amount that businesses can claim back drops to 25p per mile.

Business mileage rates are updated by HM Revenue & Customs (HMRC) every year and published here on HMRC gov.uk website.

Example: Maisie (an employee) travels 12,000 miles for work using her own car. The employer can subsidise her fuel and vehicle running costs by claiming MAPs (Mileage Allowance Payments) to the ‘Approved’ amount of £5,000 (being 10,000 x 45p plus 2,000 x 25p).

One thing to remember is that businesses can set their own limits on how much they choose to pay back their employees. The employer may choose not to cover Maisie for the full approved HMRC mileage rate and instead may choose only to pay back just 40p per mile, rather than the permitted 45p. In this situation the employee ma claim tax relief on the remaining balance (called Mileage Allowance Relief) but in our experience most small businesses we work with are happy to pay back up to the 45p HMRC approved mileage rate on the first 10,000 miles and then 25p in excess of this.

One other very important point is that regardless of how much the employer chooses to cover, if an employee has travelled more than 10,000 miles in a tax year, the employer must report this to HMRC using the form P11D. Similarly, if you choose to pay your employee any amount per mile over the approved amount, this will be classed as a benefit and will also need to be reported on a P11D and taxed accordingly.

What counts as allowable?

MAPs are available for any employee that uses their own vehicle for business travel, otherwise defined as:

- Travel between a permanent workplace and temporary work, such as to a meeting

- Travelling between temporary workplaces, such as client visits

- Travel between two workplaces owned by the same employer

- If you work from home, travel to a workplace due to the requirements of that job

You are only able to claim MAPs on any journey taken for business purposes and not for personal, therefore you CANNOT claim for commuting from home to work.

Claiming for mileage can be very admin-heavy as any claim must be supported with a record of the business journey completed, the reason for the trip, start postcode and destination postcode in order to calculate how much is to be included in any claim and also to ensure you are aware of if/when you may approach the 10,000 miles threshold during the year.

Credits and thanks: HMRC, Croner-i, Start-ups, Xero & FreeAgent

Disclaimer:

The content included in this blog post is based on our understanding of tax and company law at the time of publication. It may be subject to change without notice and may not be applicable to your circumstances, so should not be relied upon.